Want to sell your inherited house?

Have you recently inherited a house and you’re not sure what to do with it?

Depending on the condition of the house, your location, and your circumstances getting a house from a loved one can be a blessing or it may be something that creates some major obstacles in your life. There are 3 things you can do with the house: move into it, rent it out, or sell it. But, before we dive into all that, I want you to take a deep breath and figure out the answers to the questions below. Once you have all this information in front of you, it will be much easier for you to figure out your next steps!

Get Organized and do your research:

Does the property have a mortgage on it?

If so, find out what is owed, and how much the payment is. The next thing you need to do is make sure you inform the mortgage company that the owner has passed and you have inherited the house. They will let you know what documents they need in order to get you access to the loan information. Next, make sure that mortgage is being paid while you get through the rest of the things you need to with the property.

What if the property is behind on payments or is “underwater”?

If the house is behind on payments this may help you decide if you want to sell the property. Depending on how many back payments there are to catch up, you may just want to sell the property quickly IF there is enough equity to pay the full amount due including back payments. If there is not enough equity, sometimes the mortgage company will allow a short sale. This allows you to sell the property for less than what is owed on the mortgage. If you need to do a short sale, contact an investor. Most will either be able to do the short sale for you OR they will know who to contact!

Does the property need repairs?

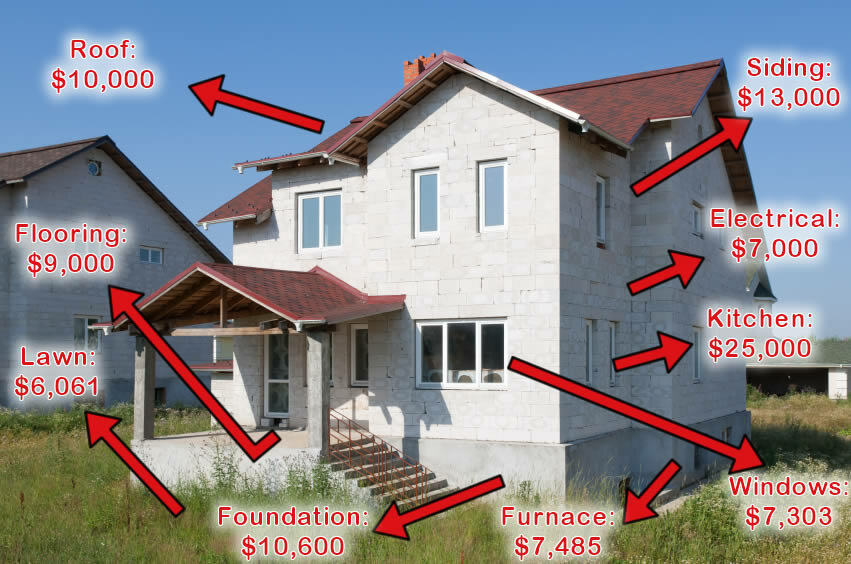

You want to take a good look at the property. Does it need a lot of cleaning out? Is it dated and needs a major renovation to get the most money out of it? There are different levels of repairs needed depending on what you want to do with the house.

- Repairs to sell: Just like any home you’d purchase for yourself, it’s always a smart idea to get a home inspection upon inheriting a home. You’ll want to know about any big-ticket repairs that need to be done before selling the home — think furnace, foundation, roof and windows. Home inspections cost between $250-$700, depending on the size of the home. Anything on this inspection is most likely going to need to be done before selling thehouse on the market with an agent.

- Repairs to rent: Renters care less about the long-term condition of a property and more about the creature comforts, like new carpet and fresh paint. Many times you can paint outdated cabinets and put some lipstick on a house and it will rent. Just remember to check what you can get for rent, and that it is more than any mortgage that may be on the property.

- Sell to an investor: Many investors, including New Generation Homes, will buy a house in “as-is” condition. Meaning you won’t have to go through the hassle of getting it renovated or making ANY repairs in order to get it sold. We can also help if you have multiple heirs or probate problems. We buy houses with problems all the time and have the network and knowledge to get things taken care of quickly!

Who has rights to the property?

If you are the only person that has rights to the property, you can do whatever makes the most sense with the property. But, if you inherit the property with another or even multiple other stakeholders, it may be a longer more difficult process. Here are some options for you to consider.

- Sell the property and split the profits: It may be the easiest option to sell the house and split the profits if there are multiple people involved. If you sell to an investor you will know the exact split you will get after closing. If you fix up the house and put it on the market, remember you may have additional fix up costs, and you have to remember you will be splitting what is left after expenses and commissions.

- Rent and split the profits: We obviously believe in keeping real estate as long as possible! It is a great investment. But, it can cause problems when repairs need to be paid for or a house and renters need to be managed and multiple people own the house. You need to know who is going to take responsibility for what and then how each party will be compensated.

- Buyout: One party could buy the other parties out.

Capital Gains when selling an Inherited Property

Inherited properties get a “stepped-up” tax basis. This means that you don’t have to pay capital gains tax from when the previous owner purchased the property. They go off the value of the property when you inherit it.

If you end up holding the property for a while, you will pay capital gains tax on any increase in the value of the property. Remember that estate taxes are different from inheritance taxes. All of this can be very complicated so make sure you talk to an accountant or CPA before making any important decisions.

So, now that you know what information you need to gather in order to weigh your options, and the questions you need to ask yourself, go ahead and get started. But also remember that New Generation Home Buyers can help you through this process! Even if we DON’T buy the house! Our business is that of solving peoples real estate problems, and sometimes that means we help even when we are not the ones that are going to buy the house!

We have been in the business for over 20 years and have a lot of knowledge. We are happy to help you with any questions you have. If you are ready to get some answers, give us a call or fill out the form on the contact us page.